Copper - (Cu)

Melting

Point:

1981

Fahrenheit

\ 1083

Celsius

Boiling Point: 4643 Fahrenheit \ 2562 Celsius

Copper is a ductile metal with very high thermal and electrical conductivity which is the second highest among pure metals at room temperature.. Pure copper is soft and malleable; an exposed surface has a reddish-orange tarnish. It is used as a conductor of heat and electricity, a building material, and a constituent of various metal alloys. Copper has excellent brazing and soldering properties and can be welded; the best results are obtained with gas metal arc welding.

Copper occurs naturally as native copper and was known to some of the oldest civilizations on record. It has a history of use that is at least 10,000 years old, and estimates of its discovery place it at 9000 BC in the Middle East;

The cultural role of copper has been important, particularly in currency. Romans in the 6th through 3rd centuries BC used copper lumps as money. At first, the copper itself was valued, but gradually the shape and look of the copper became more important. Julius Caesar had his own coins made from brass, while Octavianus Augustus Caesar's coins were made from Cu-Pb-Sn alloys. With an estimated annual output of around 15,000 t, Roman copper mining and smelting activities reached a scale unsurpassed until the time of the Industrial Revolution; the provinces most intensely mined were those of Hispania, Cyprus and in Central Europe. The Swedish Empire had the greatest and most numerous copper mines in Europe as it entered into its pre-eminence in the early 17th century. With this Sweden had a copper backed currency.

The uses of copper in art were not limited to currency: it was used in pre-photographic technology and the Statue of Liberty. Copper plating and copper sheathing for ships' hulls and the first modern electroplating plant in 1876. The major applications of copper are in electrical wires (60%), roofing and plumbing (20%) and industrial machinery (15%). Copper is mostly used as a metal, but when a higher hardness is required it is combined with other elements to make an alloy (5% of total use) such as brass and bronze. A small part of copper supply is used in production of compounds for nutritional supplements and fungicides in agriculture. Copper is an essential trace element in plants and animals, but not some microorganisms. The human body contains copper at a level of about 1.4 to 2.1 mg per kg of body mass.

The electrical properties of copper are exploited in copper wires and devices such as electromagnets. Integrated circuits and printed circuit boards increasingly feature copper in place of aluminum because of its superior electrical conductivity (see Copper interconnect for main article); heat sinks and heat exchangers use copper as a result of its superior heat dissipation capacity to aluminum. Vacuum tubes, cathode ray tubes, and the magnetrons in microwave ovens use copper, as do wave guides for microwave radiation.

Machining of copper is possible, although it is usually necessary to use an alloy for intricate parts to get good machinability characteristics.

Copper Alloys

101 - Ultra Conductive

102 - Ultra Conductive

110 - Multipurpose

122 - Weldable

145 - Machinable

182 - High Strength

Numerous copper alloys exist, many with important uses. Brass is an alloy of copper and zinc and bronze usually refers to copper-tin alloys, but can refer to any alloy of copper such as aluminum bronze. Copper is one of the most important constituents of carat silver and gold alloys and carat solders used in the jewelry industry, modifying the color, hardness and melting point of the resulting alloys.

The alloy of copper and nickel, called cupronickel, is used in low-denomination statuary coins, often for the outer cladding. The US 5-cent coin called nickel consists of 75% copper and 25% nickel and has a homogeneous composition. The 90% copper/10% nickel alloy is remarkable by its resistance to corrosion and is used in various parts being exposed to seawater. Alloys of copper with aluminum (about 7%) have a pleasant golden color and are used in decorations. Copper alloys with tin are part of lead-free solders.

Metals and Currency and You!

Copper Pennies vs. Zinc Pennies

As

already

stated

copper has

played a

role

through

out

history as

currency

even

commodity

backed

paper

currencies.

In the

USA,

Before

1982,

pennies

were

composed

of

approximately

95%

copper.

The

remaining

5% of

material

was

basically

composed

of zinc.

However,

the U.S.

government

realized

in the

late 70’s

and early

80’s that

copper

prices

would

begin to

rise very

soon. They

decided to

alter the

way in

which

copper

pennies

were

produced.

Instead of

being

mostly

copper,

the

pennies

were now

made out

of about

97.5%

zinc. The

remaining

2.5% was

comprised

of a thin

copper

coating.

By doing

this, the

U.S.

government

was able

to save

money and

avoid

unnecessary

spending

when

copper

prices

began to

rise,

which they

did

shortly

thereafter.

As

already

stated

copper has

played a

role

through

out

history as

currency

even

commodity

backed

paper

currencies.

In the

USA,

Before

1982,

pennies

were

composed

of

approximately

95%

copper.

The

remaining

5% of

material

was

basically

composed

of zinc.

However,

the U.S.

government

realized

in the

late 70’s

and early

80’s that

copper

prices

would

begin to

rise very

soon. They

decided to

alter the

way in

which

copper

pennies

were

produced.

Instead of

being

mostly

copper,

the

pennies

were now

made out

of about

97.5%

zinc. The

remaining

2.5% was

comprised

of a thin

copper

coating.

By doing

this, the

U.S.

government

was able

to save

money and

avoid

unnecessary

spending

when

copper

prices

began to

rise,

which they

did

shortly

thereafter.

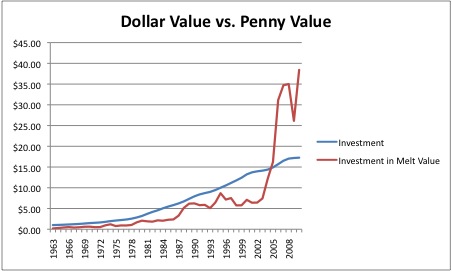

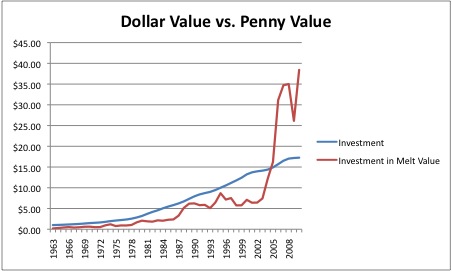

Because copper prices did rise as expected, the actual value of the metal in a copper penny now is more than twice its face value of one cent denomination at .025 cents in metal value. In

1963, you

would have

actually

been

losing

money.

$1.00 in

pennies

was only

worth 19¢

in copper.

Today, you

would have

more than

doubled

your

investment.

$1.00 in

(pre-1982)

pennies is

now worth

2.50¢ in

copper.

In

1963, you

would have

actually

been

losing

money.

$1.00 in

pennies

was only

worth 19¢

in copper.

Today, you

would have

more than

doubled

your

investment.

$1.00 in

(pre-1982)

pennies is

now worth

2.50¢ in

copper.

The 20th century saw a gradual movement to fiat currency; backed by both controlled government and corporate sponsored media centers and the international "private" banking system to promote them. In a world where once all currency was backed up by one to one commodity based sovereign currencies, now all countries use declared value non-commodity reserve currencies. Example: The Federal Reserve Note is not Federal but Private Bank, Has NO Commodity Reserves to back up the paper/digital Note or IOU. Even the use of metal in coinage has changed from previously used pure base metals as copper or nickel to more lesser value substitutes of metal alloys which are under way to an completely planned digital global currency of replacement.

This is a controversial topic for Constitutionalist and many others who studied more closely the linking's of those with ulterior motives of control over our countries monetary system and the country itself. The United States Constitution declares, in Article I, Section 10, "No State shall... make any Thing but gold and silver Coin a Tender in Payment of Debts". Yet without a Constitutional Amendment and by just Act of Congress in the midnight hour they passed the Federal Reserve Private Banking System was passed. Hear Free audio Link on this. (opens in new window)

Also to this controversy, the move to fractionalized fiat (money just declared) causes lack of connection to accountability. When the government borrows currency through the printing press, and the creation of such new currency is backed by no real commodities, the creation of that currency is inflationary, and arguably counterfeit. Certainly such an action is similar to a person creating currency in his or her basement. Whether or not such an action can be correctly interpreted as counterfeiting, there can be no doubt that inflating the currency is criminal. Many feel this is also the cause for a condition where the country's debt has now out paced in fiat currency available to pay it. Many believe there is a reality of current currency collapse in the USA and Globally.

When one to one commodities are traded against their same or difference in values a certainty of confidence is also traded. The fiat currency proponents claim it is all a confidence game any way which is true until the confidence is gone by just declaring fair value exchange with no reasonable relationship to it. An example being when the uncoupling occurs of any tangible REAL commodity to vast differences against worthless paper or digital money to the reality of actual supply as in more debt than physical assets to pay off the debt. This can be seen in recent history by many countries in default or on the precipice of default like with the USA with the country's mega trillion deficit against Gross National Product, or a 700 plus trillion dollar unregulated derivatives (form of commodity insurance) market greater than physical commodities or currency on record to offset it. This can cause a melt down in fiat claims of value giving way to hyper inflation to balance and or collapse back down to commodity realities. Example: Pre-USA during the Revolutionary War it was said that because of inflated borrowed promissory money, it took a wagon load of money to buy a wagon load of supplies.

Here are some examples of recent fiat currencies in dollar inflations and collapse.

One dollar bill inflated to...

Zimbabwe – 100 trillion dollars, 2006

Venezuela – 10,000 bolívares, 2002

Romania – 50,000 lei, 2001

Turkey – 5 million lira, 1997

Belarus – 100,000 rubles, 1996

Ukraine – 10,000 karbovantsiv, 1995

Angola – 500,000 kwanzas reajustados, 1995

Georgia – 1 million laris, 1994

Yugoslavia – 10 billion dinar, 1993

Brazil – 500 cruzeiros reais, 1993

Russia – 10,000 rubles, 1992

Zaire – 5 million zaires, 1992

Nicaragua – 10 million córdobas, 1990

Peru – 100,000 intis, 1989

Bolivia – 5 million pesos bolivianos, 1985

Argentina – 10,000 pesos argentinos, 1985

Bolivia – 5 million pesos bolivianos, 1985

Chile – 10,000 pesos, 1975

One such famous default was the Mexican Peso in 1994 called, The 1994 Economic Crisis in Mexico, widely known as the Mexican peso crisis or the Tequila crisis, was caused by the sudden devaluation of the Mexican peso in December 1994. As each currency implodes and a shift of resources rush in to fill the vacuum it dilutes even further the remaining commodity / currency valuations. Now many countries globally have faltering currencies and high defecates threatening the global economic structure in a much fear realistic domino effect. When fiat currencies collapse all resorts back down to realistic trade / barter of all commodities be it food or supplies and raw materials including metals. Those with commodities in had can then easily exchange into the next currency structure an the new given rate if desired whereas those who held the previous fiat currency have nothing to show for it.

History repeats itself. Besides Copper ingots for industry, more and more you will find available smaller copper bullion bars as a currency commodity value to own. Prices are in many cases well above the metals spot price as a substitute for Gold and Silver Billion now out of reach for many to own due to high value prices. Copper bullion is one of the most exciting and fastest evolving areas within metals.

Copper like Gold and Silver, even Brass, Bronze or other real commodity metals in any quantities are good to obtain, own, and have on hand to hedge and trade against inflation or worse, currency collapse.

About Metal Spot Prices: The spot price of metals is based on paper contracts for delivery of tons of pure metal ingots. When you're not prepared to pay for and take delivery of tons of metal ingots, that spot price will quickly become a huge understatement of the real price of that metal. When you want to buy just a few pounds of copper for example, you're looking at substantially higher prices. Moreover, once you own physical copper bullion, make absolutely sure you never sell for the spot price of copper. Because it's hard to get investment grade copper in physical form, you've got something special on your hands and make sure to extract the full value when you're selling! (Our personal opinion: A sure way to fast wealth... Don't sell and hold for the long term. If selling.. Get Top $) .

Boiling Point: 4643 Fahrenheit \ 2562 Celsius

Copper is a ductile metal with very high thermal and electrical conductivity which is the second highest among pure metals at room temperature.. Pure copper is soft and malleable; an exposed surface has a reddish-orange tarnish. It is used as a conductor of heat and electricity, a building material, and a constituent of various metal alloys. Copper has excellent brazing and soldering properties and can be welded; the best results are obtained with gas metal arc welding.

Copper occurs naturally as native copper and was known to some of the oldest civilizations on record. It has a history of use that is at least 10,000 years old, and estimates of its discovery place it at 9000 BC in the Middle East;

The cultural role of copper has been important, particularly in currency. Romans in the 6th through 3rd centuries BC used copper lumps as money. At first, the copper itself was valued, but gradually the shape and look of the copper became more important. Julius Caesar had his own coins made from brass, while Octavianus Augustus Caesar's coins were made from Cu-Pb-Sn alloys. With an estimated annual output of around 15,000 t, Roman copper mining and smelting activities reached a scale unsurpassed until the time of the Industrial Revolution; the provinces most intensely mined were those of Hispania, Cyprus and in Central Europe. The Swedish Empire had the greatest and most numerous copper mines in Europe as it entered into its pre-eminence in the early 17th century. With this Sweden had a copper backed currency.

The uses of copper in art were not limited to currency: it was used in pre-photographic technology and the Statue of Liberty. Copper plating and copper sheathing for ships' hulls and the first modern electroplating plant in 1876. The major applications of copper are in electrical wires (60%), roofing and plumbing (20%) and industrial machinery (15%). Copper is mostly used as a metal, but when a higher hardness is required it is combined with other elements to make an alloy (5% of total use) such as brass and bronze. A small part of copper supply is used in production of compounds for nutritional supplements and fungicides in agriculture. Copper is an essential trace element in plants and animals, but not some microorganisms. The human body contains copper at a level of about 1.4 to 2.1 mg per kg of body mass.

The electrical properties of copper are exploited in copper wires and devices such as electromagnets. Integrated circuits and printed circuit boards increasingly feature copper in place of aluminum because of its superior electrical conductivity (see Copper interconnect for main article); heat sinks and heat exchangers use copper as a result of its superior heat dissipation capacity to aluminum. Vacuum tubes, cathode ray tubes, and the magnetrons in microwave ovens use copper, as do wave guides for microwave radiation.

Machining of copper is possible, although it is usually necessary to use an alloy for intricate parts to get good machinability characteristics.

Copper Alloys

101 - Ultra Conductive

102 - Ultra Conductive

110 - Multipurpose

122 - Weldable

145 - Machinable

182 - High Strength

Numerous copper alloys exist, many with important uses. Brass is an alloy of copper and zinc and bronze usually refers to copper-tin alloys, but can refer to any alloy of copper such as aluminum bronze. Copper is one of the most important constituents of carat silver and gold alloys and carat solders used in the jewelry industry, modifying the color, hardness and melting point of the resulting alloys.

The alloy of copper and nickel, called cupronickel, is used in low-denomination statuary coins, often for the outer cladding. The US 5-cent coin called nickel consists of 75% copper and 25% nickel and has a homogeneous composition. The 90% copper/10% nickel alloy is remarkable by its resistance to corrosion and is used in various parts being exposed to seawater. Alloys of copper with aluminum (about 7%) have a pleasant golden color and are used in decorations. Copper alloys with tin are part of lead-free solders.

Metals and Currency and You!

Copper Pennies vs. Zinc Pennies

As

already

stated

copper has

played a

role

through

out

history as

currency

even

commodity

backed

paper

currencies.

In the

USA,

Before

1982,

pennies

were

composed

of

approximately

95%

copper.

The

remaining

5% of

material

was

basically

composed

of zinc.

However,

the U.S.

government

realized

in the

late 70’s

and early

80’s that

copper

prices

would

begin to

rise very

soon. They

decided to

alter the

way in

which

copper

pennies

were

produced.

Instead of

being

mostly

copper,

the

pennies

were now

made out

of about

97.5%

zinc. The

remaining

2.5% was

comprised

of a thin

copper

coating.

By doing

this, the

U.S.

government

was able

to save

money and

avoid

unnecessary

spending

when

copper

prices

began to

rise,

which they

did

shortly

thereafter.

As

already

stated

copper has

played a

role

through

out

history as

currency

even

commodity

backed

paper

currencies.

In the

USA,

Before

1982,

pennies

were

composed

of

approximately

95%

copper.

The

remaining

5% of

material

was

basically

composed

of zinc.

However,

the U.S.

government

realized

in the

late 70’s

and early

80’s that

copper

prices

would

begin to

rise very

soon. They

decided to

alter the

way in

which

copper

pennies

were

produced.

Instead of

being

mostly

copper,

the

pennies

were now

made out

of about

97.5%

zinc. The

remaining

2.5% was

comprised

of a thin

copper

coating.

By doing

this, the

U.S.

government

was able

to save

money and

avoid

unnecessary

spending

when

copper

prices

began to

rise,

which they

did

shortly

thereafter.Because copper prices did rise as expected, the actual value of the metal in a copper penny now is more than twice its face value of one cent denomination at .025 cents in metal value.

In

1963, you

would have

actually

been

losing

money.

$1.00 in

pennies

was only

worth 19¢

in copper.

Today, you

would have

more than

doubled

your

investment.

$1.00 in

(pre-1982)

pennies is

now worth

2.50¢ in

copper.

In

1963, you

would have

actually

been

losing

money.

$1.00 in

pennies

was only

worth 19¢

in copper.

Today, you

would have

more than

doubled

your

investment.

$1.00 in

(pre-1982)

pennies is

now worth

2.50¢ in

copper.The 20th century saw a gradual movement to fiat currency; backed by both controlled government and corporate sponsored media centers and the international "private" banking system to promote them. In a world where once all currency was backed up by one to one commodity based sovereign currencies, now all countries use declared value non-commodity reserve currencies. Example: The Federal Reserve Note is not Federal but Private Bank, Has NO Commodity Reserves to back up the paper/digital Note or IOU. Even the use of metal in coinage has changed from previously used pure base metals as copper or nickel to more lesser value substitutes of metal alloys which are under way to an completely planned digital global currency of replacement.

This is a controversial topic for Constitutionalist and many others who studied more closely the linking's of those with ulterior motives of control over our countries monetary system and the country itself. The United States Constitution declares, in Article I, Section 10, "No State shall... make any Thing but gold and silver Coin a Tender in Payment of Debts". Yet without a Constitutional Amendment and by just Act of Congress in the midnight hour they passed the Federal Reserve Private Banking System was passed. Hear Free audio Link on this. (opens in new window)

Also to this controversy, the move to fractionalized fiat (money just declared) causes lack of connection to accountability. When the government borrows currency through the printing press, and the creation of such new currency is backed by no real commodities, the creation of that currency is inflationary, and arguably counterfeit. Certainly such an action is similar to a person creating currency in his or her basement. Whether or not such an action can be correctly interpreted as counterfeiting, there can be no doubt that inflating the currency is criminal. Many feel this is also the cause for a condition where the country's debt has now out paced in fiat currency available to pay it. Many believe there is a reality of current currency collapse in the USA and Globally.

When one to one commodities are traded against their same or difference in values a certainty of confidence is also traded. The fiat currency proponents claim it is all a confidence game any way which is true until the confidence is gone by just declaring fair value exchange with no reasonable relationship to it. An example being when the uncoupling occurs of any tangible REAL commodity to vast differences against worthless paper or digital money to the reality of actual supply as in more debt than physical assets to pay off the debt. This can be seen in recent history by many countries in default or on the precipice of default like with the USA with the country's mega trillion deficit against Gross National Product, or a 700 plus trillion dollar unregulated derivatives (form of commodity insurance) market greater than physical commodities or currency on record to offset it. This can cause a melt down in fiat claims of value giving way to hyper inflation to balance and or collapse back down to commodity realities. Example: Pre-USA during the Revolutionary War it was said that because of inflated borrowed promissory money, it took a wagon load of money to buy a wagon load of supplies.

Here are some examples of recent fiat currencies in dollar inflations and collapse.

One dollar bill inflated to...

Zimbabwe – 100 trillion dollars, 2006

Venezuela – 10,000 bolívares, 2002

Romania – 50,000 lei, 2001

Turkey – 5 million lira, 1997

Belarus – 100,000 rubles, 1996

Ukraine – 10,000 karbovantsiv, 1995

Angola – 500,000 kwanzas reajustados, 1995

Georgia – 1 million laris, 1994

Yugoslavia – 10 billion dinar, 1993

Brazil – 500 cruzeiros reais, 1993

Russia – 10,000 rubles, 1992

Zaire – 5 million zaires, 1992

Nicaragua – 10 million córdobas, 1990

Peru – 100,000 intis, 1989

Bolivia – 5 million pesos bolivianos, 1985

Argentina – 10,000 pesos argentinos, 1985

Bolivia – 5 million pesos bolivianos, 1985

Chile – 10,000 pesos, 1975

One such famous default was the Mexican Peso in 1994 called, The 1994 Economic Crisis in Mexico, widely known as the Mexican peso crisis or the Tequila crisis, was caused by the sudden devaluation of the Mexican peso in December 1994. As each currency implodes and a shift of resources rush in to fill the vacuum it dilutes even further the remaining commodity / currency valuations. Now many countries globally have faltering currencies and high defecates threatening the global economic structure in a much fear realistic domino effect. When fiat currencies collapse all resorts back down to realistic trade / barter of all commodities be it food or supplies and raw materials including metals. Those with commodities in had can then easily exchange into the next currency structure an the new given rate if desired whereas those who held the previous fiat currency have nothing to show for it.

For more

information

on this by

non-corporate

and

non-mass

media

government

controlled

information

see the

following

open

information

link.

Click >

FREEDOM

OF INFORMATION CENTER (opens in new window)

History repeats itself. Besides Copper ingots for industry, more and more you will find available smaller copper bullion bars as a currency commodity value to own. Prices are in many cases well above the metals spot price as a substitute for Gold and Silver Billion now out of reach for many to own due to high value prices. Copper bullion is one of the most exciting and fastest evolving areas within metals.

Copper like Gold and Silver, even Brass, Bronze or other real commodity metals in any quantities are good to obtain, own, and have on hand to hedge and trade against inflation or worse, currency collapse.

About Metal Spot Prices: The spot price of metals is based on paper contracts for delivery of tons of pure metal ingots. When you're not prepared to pay for and take delivery of tons of metal ingots, that spot price will quickly become a huge understatement of the real price of that metal. When you want to buy just a few pounds of copper for example, you're looking at substantially higher prices. Moreover, once you own physical copper bullion, make absolutely sure you never sell for the spot price of copper. Because it's hard to get investment grade copper in physical form, you've got something special on your hands and make sure to extract the full value when you're selling! (Our personal opinion: A sure way to fast wealth... Don't sell and hold for the long term. If selling.. Get Top $) .

Accuracy of Information

The information on the Website is provided to you "as is" by TheFoundryZone.com in good faith and has been derived from sources believed by TheFoundryZone.com to be reliable and accurate at the time of providing it. TheFoundryZone.com does not guarantee the accuracy, completeness or currency of information. Use of the Website and its contents is at your own risk. See Web Site: Terms of Use.